With the latest EU/ UK VAT regulations and its following updates (Brexit as well), any physical or digital goods that are sold to consumers in the European Union countries are liable to EU VAT, regardless of the seller location.

EU/UK VAT for WooCommerce plugin will let you collect VAT number on checkout, and optionally validate VAT against the official EU/UK VAT database to confirm the VAT number, then automatically exempt VAT for the validated number.

The plugin also includes a tax tool, within a single click you will be able to add all EU country VAT standard rates to your WooCommerce store.

Main Features

- Set frontend options: You can customize field label, placeholder, description to the text/language of your preference, take control of position, CSS class as well.

- Set if VAT field is required on checkout: It will give you the option to make the field mandatory or optional, and even when it’s left optional, you can still show the customer a confirmation notice to make sure they didn’t leave it blank by mistake.

- Set if VAT field needs to be validated: This option will let your store validate the EU VAT number using VIES SOAP in real-time to guarantee a valid VAT number.

- Automatically exempt VAT for valid VAT numbers.

- Optionally check for matching billing country code.

- Optionally allow VAT number input without country code.

- Customize progress messages.

- Set display options (after order table and/or in billing address).

- Optionally always show zero VAT.

- WPML/Polylang compatible.

- Automatically exempt/not exempt VAT for selected user roles.

- EU VAT report.

Premium Version

Our extended EU/UK VAT for WooCommerce Pro plugin allows you to:

- Preserve VAT in selected countries.

- Check country by IP.

- Show field for selected countries only.

- Show field for selected user roles only.

- Validate company name.

Demo Store

If you want to try the plugin features and play around with its settings before installing it on your live website, feel free to do so on this demo store:

URL: https://wpwhale.com/demo/wp-admin/

User: demo

Password: G6_32e!r@

Download & install the zip archive

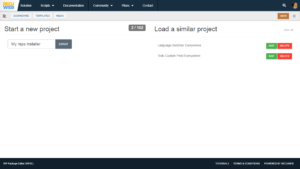

The plugin package installer can be downloaded from the WP2E project tab called “code”.

1 – Select the version to download if this option is available otherwise the “latest” version of the main plugin will be used.

2 – After downloading the zip archive install the plugin package installer in you local environment and activate the script from the plugin list.

3 – Under the section “Plugins” of the admin dashboard you should see a new “Dependencies & Licenses” link. Follow the instructions from this panel to finalize the installation of the missing dependencies.

- Give a name to your project

- Download the Installer Package

- Install & activate the plugin locally

- Install the suggested dependencies

Tips: Use the WP2E panel to add/suggest new dependencies to the local installation. Press F5 in the list of dependencies if the changes are not displayed right away.